We have developed a complete technology incubation programme that spans from research through to company growth, utilising our proprietary process for venture development. This process is underpinned by our advanced opportunity assessment tools.

Technology-market assessment

The opportunity assessment is carried out by applying our standard assessment tools. Having developed a standardised approach, we are now able to utilise students to screen and evaluate IP. This part of the process involves identifying potential customer groups, followed by one-on-one discussions to understand how they value solutions. As the customer need is identified, performance specifications can then be developed. These specifications define clearly what the entrepreneur or researcher must achieve to have a viable product.

Importantly, this activity provides valuable market insight into the research process – early feedback for the research groups. In particular, the customer specifications provide researchers with a quantifiable target for their work. And entrepreneurs gain the important market validation of their idea.

As part of this work we conduct freedom-to-operate searches and develop an IP strategy, conducted in-house by our own IP specialist. This activity forms a crucial element of our technology assessment and road map development.

Technology incubation

Ventures enter technology incubation as a result of an identified customer need. The objective of this phase is to find an appropriate customer to trial the product, attract pre-seed funding from our own dedicated fund, and then get product into the hands of the customer.

Sourcing of industry mentor and interim CEO

During the technology incubation stage we source an industry mentor with market or industry relevant experience. Someone who can help validate the opportunity and develop an investment case.

An interim CEO is also identified, typically with a technical background suitable for interpreting the requirements of customers and acting as an interface to the research groups.

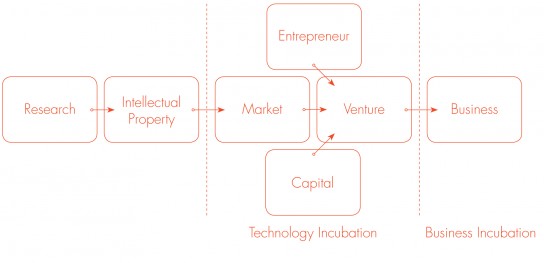

This diagram shows the major steps in the process we take to create successful new ventures.

Our Venture Partners assist the interim CEO through this phase, under the essential guidance of the industry mentor, normally forming a company at the appropriate time. As the venture progresses to becoming a company, the industry mentor typically becomes a non-executive director.

Access to proof of concept fund

Initially, only a small amount of capital is invested, focused on customer trials of a prototype. The purpose of this initial proof of concept funding is to build the case for a seed round investment. Ideally this investment is made alongside Pre-Seed Accelerator funding.

Business incubation

Although some companies enter business incubation directly, it is more usual to progress from technology incubation.

Ventures progress through to business incubation following investment and customer trials. As part of the investment, PVL appoints a three person board — the principal researcher (or a representative of the research institute); a PVL representative; and an independent director (often the industry mentor previously identified).

Access to seed capital and strategic investors

Seed capital is sourced to fund the expansion of the management team, as the company works towards early revenues and profit. Completion of the seed round typically requires a co-investment partner that brings strategic insight to assist with market penetration and global expansion.

Sourcing talent

A survey of university and CRI spinout companies in 2005 by NZIER highlighted that after access to capital, recruiting people is the second biggest challenge facing spinout companies. This is not only at staff level but also for the board of directors.

To aid in sourcing non-executives, we have accumulated an extensive database of potential candidates, drawing from current company directors to industry gurus. Our database includes sector and location data. Our wide networks are effective in identifying employment candidates for our clients. We also provide clients with access to psychometric testing (in particular, entrepreneurial testing) to improve staff selection at this critical stage.

Growth

To support our clients’ growth beyond incubation we provide essential portfolio support including: access to capital and deal making experience; support in developing the management team; and board recruitment.

A survey of New Zealand’s reasearch-based spin-outs shows that many progress to profitability but very few progress into large companies. We believe the targeted support we offer and the platform we have established will see our ventures surpass the New Zealand average.